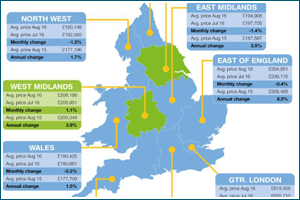

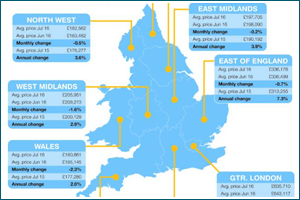

In The Month of August prices have decreased in the East Anglia market place by 0.4 however this still means that prices have increased nationally by an astonishing 8.2%, which still means we are the largest growth area in the UK.

In The Month of August prices have decreased in the East Anglia market place by 0.4 however this still means that prices have increased nationally by an astonishing 8.2%, which still means we are the largest growth area in the UK.

Below Market Value Properties

I’m hearing a lot at the moment about people wanting to purchase below market value properties. Of Course, everybody would want to buy something under market value, however here are some facts that may make your view of these so-called properties change.

I’m hearing a lot at the moment about people wanting to purchase below market value properties. Of Course, everybody would want to buy something under market value, however here are some facts that may make your view of these so-called properties change.

Interest rates dropped to all time low

The Bank of England have dropped interest rates to an all time low of 0.25%

The Bank of England have dropped interest rates to an all time low of 0.25%

So what does that mean to you and me? Well it means that there will be a little bit more money in people’s pockets and borrowing money is a bit cheaper. We have been stable at a half percent interest rate for around seven years now and lets face it it, it is not any major surprise that the Bank of England has done this….

House price growth this year

According to the newly released Rightmove monthly statistics, East of England is still the most successful district within the UK for Price growth in 2016. The annual change so far this year has been an increase of 7.3% showing an average price with the East Anglia area of £336,000

According to the newly released Rightmove monthly statistics, East of England is still the most successful district within the UK for Price growth in 2016. The annual change so far this year has been an increase of 7.3% showing an average price with the East Anglia area of £336,000

Maximise your garden

When it comes to selling a property it’s very easy to get carried away with the internal beautification, but… it is just as important to remember that the outside of any property not only gives the first impression but also generally creates what most people consider another room outside.

When it comes to selling a property it’s very easy to get carried away with the internal beautification, but… it is just as important to remember that the outside of any property not only gives the first impression but also generally creates what most people consider another room outside.

Brexit on reflection

It won’t come as a surprise that the recent referendum decision ground the Norwich housing market to a standstill. BUT… Three weeks on it is a completely different scenario. We are experiencing a far higher level of valuation requests and we are seeing significantly more property coming onto the Norwich property market.

It won’t come as a surprise that the recent referendum decision ground the Norwich housing market to a standstill. BUT… Three weeks on it is a completely different scenario. We are experiencing a far higher level of valuation requests and we are seeing significantly more property coming onto the Norwich property market.

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- 10

- 11

- Next Page »